Easy Money and Veblen Goods

The Reflexivity of Value

Key Takeaways

- •Crypto markets went up, people cashed out, and are playing with house money.

- •People's wants are influenced by others' desires, creating self-reinforcing price cycles.

With a low of $0.00099 according to Buy Bitcoin Worldwide and an all-time high of $68,958.00 according to Bitbo Calendar, Bitcoin increased in value by 6,965,454,545.45% between 2010 and 2021. Billions have been raised to support the burgeoning blockchain industry, and cryptocurrencies surpassed $3.3 trillion in total market capitalization at their peak. According to Chainalysis, over $160 billion as reported on Twitter in crypto gains was realized in 2021-$76.3b in ETH, $74.7b in BTC, and $11.7b in all altcoins.

Many millionaires and a few billionaires were minted during this time, and all this money needed to go somewhere.

The new money crowd wields newfound power that wasn't possible until a few years ago. Blockchains and non-custodial wallets let anyone take complete control of their financial assets in an unprecedented practice known as self-custody. Assets are no longer custodied by banks or investment firms; instead, they remain decentralized, on-chain assets globally trading in liquid markets 24 hours a day. The ability to 100x or -100% on a portfolio has never been easier.

Goods

Normal

Normal goods are purchased more often when incomes rise, and discretionary spending refers to purchasing non-essential items.

Below are some examples of discretionary spending on everyday goods.

- Buying the newest iPhone when your current one works fine.

- Buying an expensive latte machine when your drip coffee maker works fine.

- Going on vacation.

Most high-quality items are normal goods. Inferior goods, on the other hand, are items that you buy less of as your income rises. These are usually cheap substitutes for normal goods like knock-off clothing brands and low-quality food.

Veblen

Rules change when you reach the high end of the price spectrum for normal goods like cars, clothes, pens, watches, NFTs, etc. These normal goods become something else entirely–Veblen goods-items that get more valuable as their prices increase.

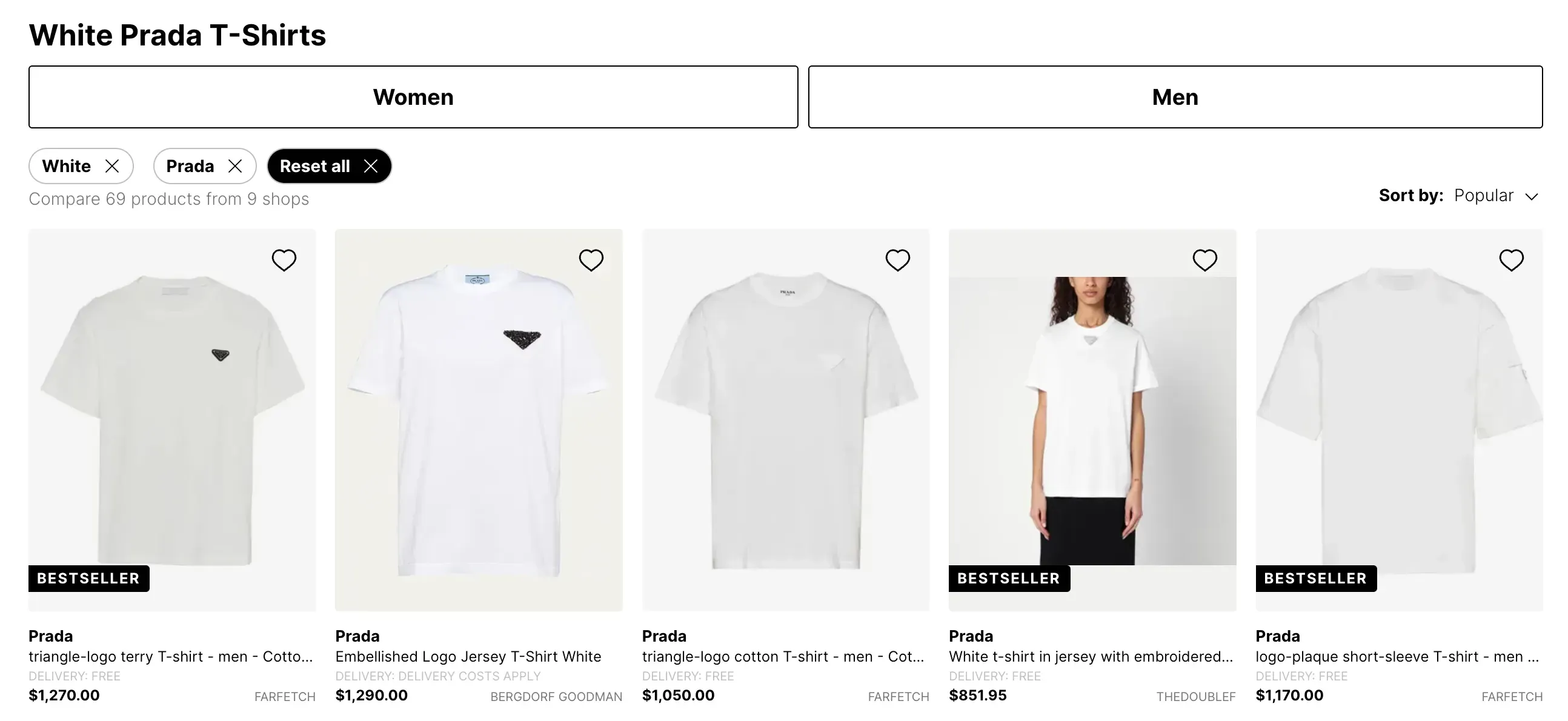

Think about the white cotton T-shirt from TJMaxx that sells for $5 and compare it to the white cotton T-shirt from Prada that sells for $500. While there may be negligible differences in material, the Prada insignia is on the Prada shirt. With that insignia comes clout and cultural significance.

This type of social engineering is a large part of what drives the prices of luxury items skyward, and NFTs are similar. A long list of reasons drives people to NFTs, but usually, it is either for the idea of buying something for X and selling it to someone for X+Y, the concept of being and owning a part of a community, or both.

So, how can you value an NFT or a set of NFTs? If you ask many of the most successful crypto traders, they would tell you to follow the cult. Notice they aren't recommending you join the cult. Instead, you observe which communities are the most cultish in their behavior and position investments accordingly. This can be carried across cryptocurrencies and NFTs, especially in NFTs and memecoins. These assets are valued at whatever someone else will pay. People notice the price going up and want to get in on it. This increases the price even more until there is a capitulation event, the average buyer is priced out, and the price starts trending down and 99% go to zero.Why do people flock to gold when financial times get rough and when more rare earth metals are out there? In short, because other people are doing it and they want to be part of the group.

Ethereum's Gas

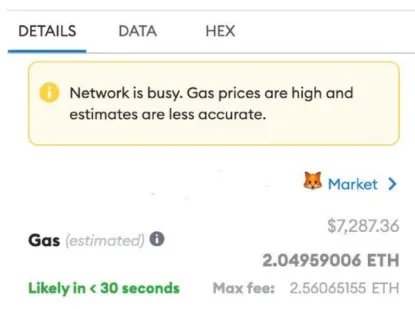

An argument for Etheruem is its relatively decentralized staking system which secures the network more than most, but most users don't care about this. They care about the fees and user experience. So when a user is willing to pay $100 for a transaction, they are willing to pay a premium for something they can do on other networks for a fraction of the cost.

In these cases, Ethereum's transaction fees can be viewed as Veblen goods. Its a bit tongue-in-cheek, but with the rise of more scalable L1s, Ethereum's fees may become more Veblen over time.

Psychology

To continue oversimplifying things, when economies bust, discretionary spending goes down. When economies boom, some normal goods transform into Veblen goods. As prices go higher, people notice. As people notice, more people buy higher, until they can't.

If BTC is up 5%, some people will buy, but many will feel like they'll have a chance to buy at a similar price later, so they don't have to buy now. If BTC is up 20%, these same people may feel like they won't be able to pay less than the current price, so they buy now. We all know this this guy.

The same goes for selling.