All writing

A Bird's Eye View

finance

$347 billion in bank fines since 2000. DeFi is the alternative.

2 min readOctober 19, 2022

Gary Gensler spent 18 years at Goldman Sachs before overseeing Wall Street as SEC Chairman. Jerome Powell built his wealth at The Carlyle Group before setting monetary policy. Janet Yellen earned $7 million in speaking fees from the banks she'd later regulate as Treasury Secretary.

The revolving door between Wall Street and Washington isn't a bug—it's the norm.

The Track Record

| Institution | Fines | Violations |

|---|---|---|

| Bank of America | $87.9B | 214 |

| JPMorgan Chase | $40.2B | 282 |

| UBS | $32.1B | 83 |

| Wells Fargo | $27.9B | 181 |

| Citigroup | $27.1B | 122 |

| Deutsche Bank | $20.0B | 59 |

| Goldman Sachs | $17.9B | 44 |

Source: Violation Tracker, January 20251

These aren't anomalies. They're structural. Financial services is the most fined industry in the world—$347 billion across just these seven institutions.2

The US dollar's reserve currency status provides flexibility other nations don't have. Global demand for dollars buffers inflationary pressures. Americans can trust that their banks will probably be there tomorrow.

Not everyone has that privilege.

Where DeFi Actually Matters

Turkey: 78% Inflation

Between 2021-2022, Turkey's inflation hit 78.62% year-over-year—the highest in 24 years.3 Local banks offered no recourse.

DeFi offered an alternative: stablecoins and non-custodial wallets to secure value, transact globally, and bypass capital controls. No bank account required. No paperwork. Just a mnemonic phrase.

China: $1.5 Billion Frozen

In 2022, Chinese authorities froze $1.5 billion in customer deposits across four Henan province banks. When depositors protested, officials manipulated COVID health tracking to restrict their travel.

Centralized systems can freeze your funds by policy decision. DeFi infrastructure is governed by code, not regional authorities.

The Yield Innovation

DeFi introduced programmable financial primitives—lending, borrowing, trading, insurance. Some protocols collapsed. Bad actors got exposed. The market selected for sustainable innovations.

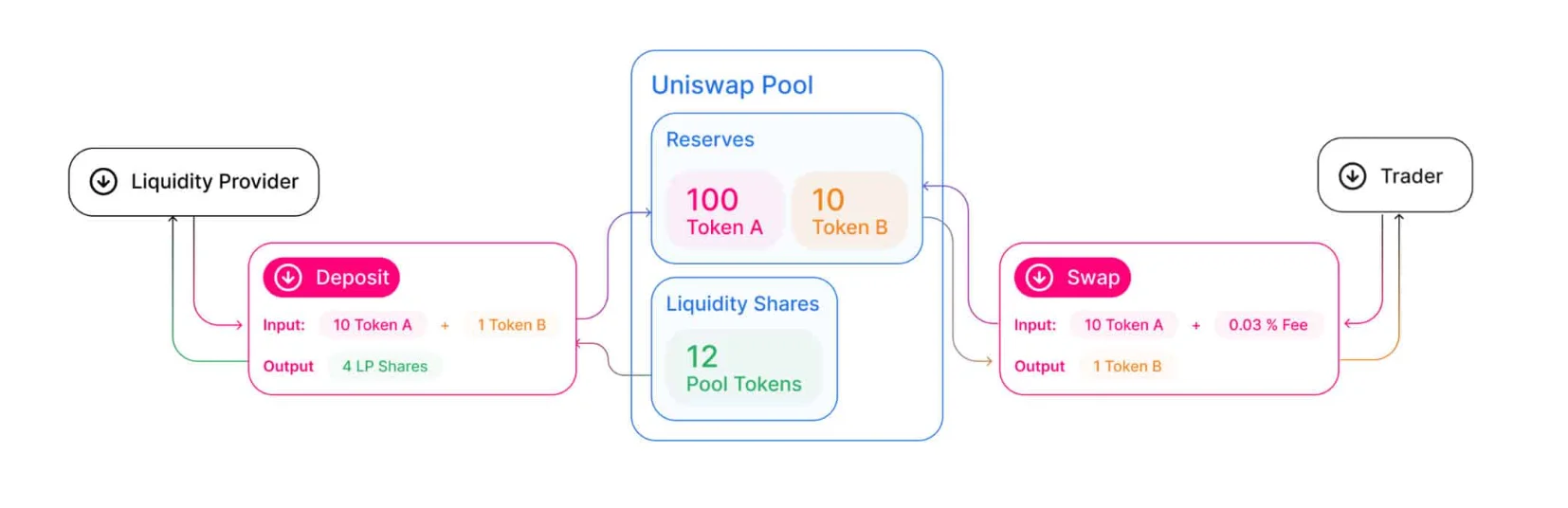

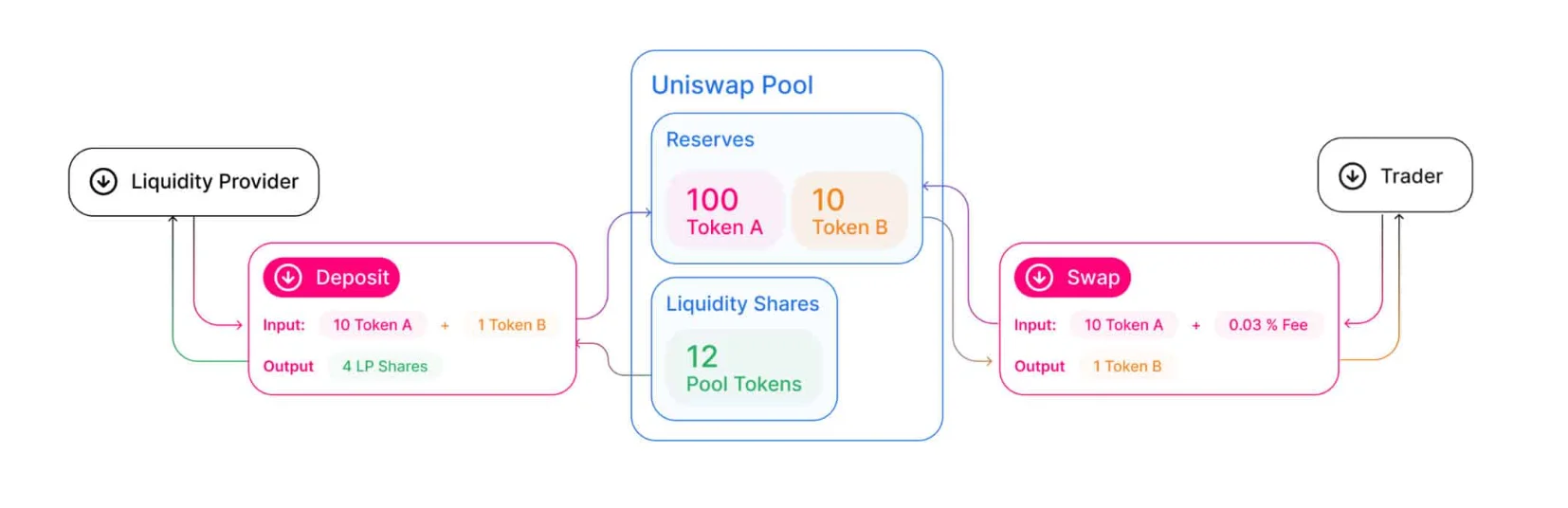

The survivors—AMMs and liquidity pools—represent DeFi at its best: transparent, permissionless infrastructure that distributes trading fees to liquidity providers instead of concentrating them among gatekeepers.

In traditional finance, market-making is gated and opaque. In DeFi, anyone can provide liquidity and earn fees. As of January 2025, DeFi protocols hold approximately $149 billion in total value locked, with Uniswap alone processing $4.3 billion in daily volume.4

The Honest Assessment

In Turkey or China, DeFi solves immediate problems. Currency devaluation, capital controls, financial repression—these aren't theoretical concerns. They're Tuesday.

In the US, traditional banking offers superior convenience, consumer protections, and reliability. Yes, banks have paid $347 billion in fines. Yes, the revolving door is real. But your checking account probably works, and if something goes wrong, there's someone to call.

DeFi's value proposition depends entirely on where you are and what you need protection from. For someone watching their government drain their savings, smart contract risk looks different than it does from a stable banking system.

The question isn't whether DeFi replaces traditional finance. It's whether you have the luxury of not needing it.

Footnotes

-

Violation Tracker is maintained by Good Jobs First, aggregating corporate misconduct penalties from government enforcement agencies. UBS's total increased substantially following the 2023 Credit Suisse acquisition, which brought legacy penalties from the acquired institution. ↩

-

For context, $347B exceeds the GDP of Finland or Chile. The violations span mortgage fraud, money laundering, sanctions violations, market manipulation, and consumer protection failures. Despite these penalties, no major bank has lost its charter. ↩

-

Turkish Statistical Institute (TÜİK), October 2022. Inflation peaked at 85.5% in October 2022 before monetary policy tightening began reducing it. As of late 2024, Turkish inflation remained elevated at approximately 50%. ↩

-

DeFiLlama aggregate data, January 2025. TVL recovered from a low of ~$37B in late 2022 following the FTX collapse. Ethereum hosts approximately 68% of total DeFi TVL, with Solana, BSC, and Arbitrum comprising most of the remainder. ↩

A Bird's Eye View

finance

$347 billion in bank fines since 2000. DeFi is the alternative.

2 min readOctober 19, 2022

crypto

Gary Gensler spent 18 years at Goldman Sachs before overseeing Wall Street as SEC Chairman. Jerome Powell built his wealth at The Carlyle Group before setting monetary policy. Janet Yellen earned $7 million in speaking fees from the banks she'd later regulate as Treasury Secretary.

The revolving door between Wall Street and Washington isn't a bug—it's the norm.

The Track Record

| Institution | Fines | Violations |

|---|---|---|

| Bank of America | $87.9B | 214 |

| JPMorgan Chase | $40.2B | 282 |

| UBS | $32.1B | 83 |

| Wells Fargo | $27.9B | 181 |

| Citigroup | $27.1B | 122 |

| Deutsche Bank | $20.0B | 59 |

| Goldman Sachs | $17.9B | 44 |

Source: Violation Tracker, January 20251

These aren't anomalies. They're structural. Financial services is the most fined industry in the world—$347 billion across just these seven institutions.2

The US dollar's reserve currency status provides flexibility other nations don't have. Global demand for dollars buffers inflationary pressures. Americans can trust that their banks will probably be there tomorrow.

Not everyone has that privilege.

Where DeFi Actually Matters

Turkey: 78% Inflation

Between 2021-2022, Turkey's inflation hit 78.62% year-over-year—the highest in 24 years.3 Local banks offered no recourse.

DeFi offered an alternative: stablecoins and non-custodial wallets to secure value, transact globally, and bypass capital controls. No bank account required. No paperwork. Just a mnemonic phrase.

China: $1.5 Billion Frozen

In 2022, Chinese authorities froze $1.5 billion in customer deposits across four Henan province banks. When depositors protested, officials manipulated COVID health tracking to restrict their travel.

Centralized systems can freeze your funds by policy decision. DeFi infrastructure is governed by code, not regional authorities.

The Yield Innovation

DeFi introduced programmable financial primitives—lending, borrowing, trading, insurance. Some protocols collapsed. Bad actors got exposed. The market selected for sustainable innovations.

The survivors—AMMs and liquidity pools—represent DeFi at its best: transparent, permissionless infrastructure that distributes trading fees to liquidity providers instead of concentrating them among gatekeepers.

In traditional finance, market-making is gated and opaque. In DeFi, anyone can provide liquidity and earn fees. As of January 2025, DeFi protocols hold approximately $149 billion in total value locked, with Uniswap alone processing $4.3 billion in daily volume.4

The Honest Assessment

In Turkey or China, DeFi solves immediate problems. Currency devaluation, capital controls, financial repression—these aren't theoretical concerns. They're Tuesday.

In the US, traditional banking offers superior convenience, consumer protections, and reliability. Yes, banks have paid $347 billion in fines. Yes, the revolving door is real. But your checking account probably works, and if something goes wrong, there's someone to call.

DeFi's value proposition depends entirely on where you are and what you need protection from. For someone watching their government drain their savings, smart contract risk looks different than it does from a stable banking system.

The question isn't whether DeFi replaces traditional finance. It's whether you have the luxury of not needing it.

Footnotes

-

Violation Tracker is maintained by Good Jobs First, aggregating corporate misconduct penalties from government enforcement agencies. UBS's total increased substantially following the 2023 Credit Suisse acquisition, which brought legacy penalties from the acquired institution. ↩

-

For context, $347B exceeds the GDP of Finland or Chile. The violations span mortgage fraud, money laundering, sanctions violations, market manipulation, and consumer protection failures. Despite these penalties, no major bank has lost its charter. ↩

-

Turkish Statistical Institute (TÜİK), October 2022. Inflation peaked at 85.5% in October 2022 before monetary policy tightening began reducing it. As of late 2024, Turkish inflation remained elevated at approximately 50%. ↩

-

DeFiLlama aggregate data, January 2025. TVL recovered from a low of ~$37B in late 2022 following the FTX collapse. Ethereum hosts approximately 68% of total DeFi TVL, with Solana, BSC, and Arbitrum comprising most of the remainder. ↩