All writing

Digital Gold

finance

Why gold is valuable tells you why Bitcoin might be

8 min readJanuary 6, 2025

Gold has 5,000 years of collective belief. Bitcoin has 16.

Whether Bitcoin becomes "digital gold" depends on the same thing gold depends on: sustained collective belief. The technology provides advantages—better portability, instant verifiability, programmable scarcity. But gold's value isn't about technology. It's about mimetic contagion: people value it because other people value it.

Key Takeaways

- Gold's value is mostly extrinsic. Beyond limited industrial use, it's valuable because we collectively believe it's valuable.

- Bitcoin offers technological advantages: portable (private keys), divisible (satoshis), verifiable (instant cryptographic proof), fixed supply (21 million cap).

- The US dollar has lost ~97% of its purchasing power since 1913. For people in Turkey or South Africa, the losses are worse and faster.

- Bitcoin's scarcity depends on ~20 lines of code and network consensus. Gold's depends on geology. Neither is absolute.

Inflation

Inflation is the rate at which the general price level of goods and services rises. Financial regulators employ various methodologies to measure inflation, and monetary policy uses inflation as a mechanism to manage debt obligations over time. This allows governments to repay debt with currency of diminished value compared to when borrowed, effectively transferring wealth from creditors to debtors. Over time, this leads to loss of purchasing power and increased nominal asset prices, primarily benefiting asset owners while impacting wage earners at the point of consumption.

Traditional financial systems have experienced persistent inflation for centuries. The US Dollar, the world's dominant reserve currency, has lost approximately 97% of its purchasing power since the Federal Reserve's establishment in 19131. To help individuals hedge against inflation, governments offer bonds that pay fixed rates of return. These returns have typically ranged between 2-4% annually over recent decades2.

Banks capitalize on the spread between rates paid to depositors on savings accounts and rates received from government bonds and lending activities3. At certain periods, while government bond yields exceeded 2%, major banks offered savings rates as low as 0.01%—a spread of nearly 200:1.

Stores of Value

Money serves three purposes: unit of account, store of value, and medium of exchange4. If currency cannot be used to purchase goods and services, it fails as money. If it loses significant value over a year, a day, or even an afternoon—as the German population experienced during the 1923 hyperinflation documented in When Money Died—it fails as money.

Rather than hold depreciating national currencies like the Turkish Lira or South African Rand and experience declining purchasing power, many individuals have adopted Bitcoin, USDT, or other cryptocurrencies that enable pseudonymous, secure value transfers and opportunities for capital appreciation. USD remains the dominant global reserve currency. All other currencies are priced against and dependent upon it. For national currencies, appreciation against USD generally indicates economic weakness, as it requires more local currency to purchase the same quantity of USD.

The Turkish Lira has lost most of its value since 2018:

Figure 1: Turkish Lira Devaluation vs USD, 2018-2025. The TRY/USD exchange rate demonstrates severe currency devaluation, with the lira losing over 80% of its value against the dollar during this period due to inflation and monetary policy challenges.

The South African Rand has experienced extreme volatility over the past decade:

Figure 2: South African Rand vs USD, 2014-2025. The ZAR/USD exchange rate exhibits sustained volatility and general depreciation trend, reflecting South Africa's economic challenges and commodity price dependencies.

Bitcoin holders have substantially outperformed holders of traditional currencies over the past decade. The famous "Bitcoin Pizza" transaction saw 10,000 BTC exchanged for two pizzas valued at approximately $25-30 on May 22, 2010, representing a price of roughly $0.0025-0.003 per BTC5. Bitcoin reached an all-time high of $126,000 in October 2025, trading around $93,000 as of January 2026.6

Figure 3: Bitcoin price, 2010-2025.

USD holders experienced significant purchasing power decline relative to Bitcoin over this period:

Figure 4: USD purchasing power vs Bitcoin, 2010-2025.

Gold

Physical gold bars have historically outperformed most assets during periods of economic uncertainty. As a result, gold has become a safe haven asset in the portfolio allocation frameworks of institutional investors.

Capital flows from speculative investments to safe-haven assets do not occur automatically. They result from investor psychology influenced by mimetic desire—people valuing assets because others value them—often manifesting gradually before accelerating rapidly in a phenomenon known as mimetic contagion.

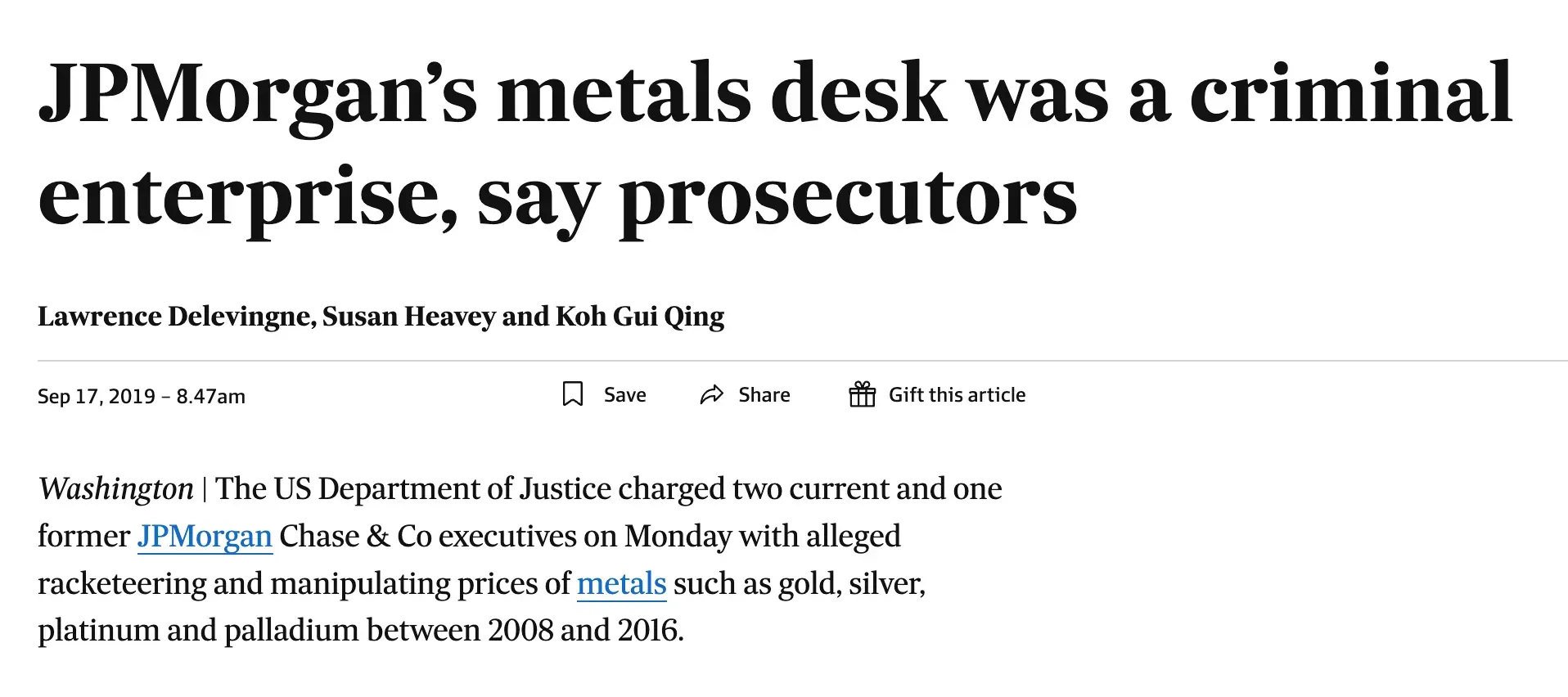

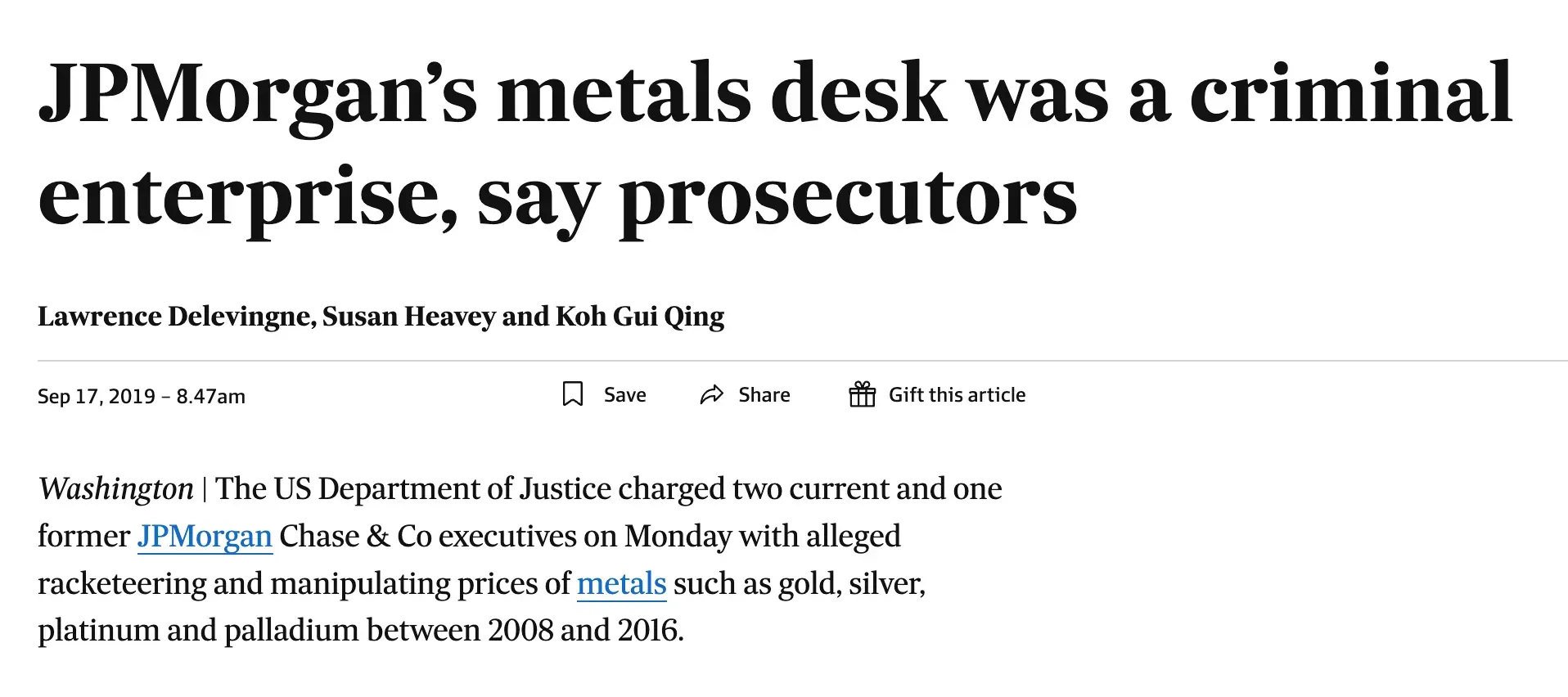

Beyond its use in jewelry and select manufacturing applications (electronics, aerospace), gold is perceived to exist outside traditional financial systems. However, central banks and financial institutions hold the largest gold reserves globally7. Gold derivatives markets are substantial, and price manipulation cases have resulted in significant regulatory enforcement actions8.

Figure 5: JPMorgan Gold Market Manipulation. JPMorgan Chase faced nearly $1 billion in fines for precious metals market manipulation, highlighting how even "safe haven" assets are subject to institutional price manipulation through derivative markets.

Digital Gold

Investors and media analysts have referred to Bitcoin as "digital gold," partly because this analogy provides the most accessible framework for understanding its market role and partly because the comparison has validity.

| Feature | Physical Gold | Bitcoin |

|---|---|---|

| Portability | Limited (heavy, physical) | Excellent (private keys enable global transfer) |

| Divisibility | Limited (physical constraints) | Highly divisible (to 8 decimal places: satoshis) |

| Verifiability | Requires testing (assay, purity tests) | Instant, certain (cryptographic verification) |

| Transfer | Slow, expensive (shipping, insurance) | Near-instant, global (blockchain settlement) |

| Storage | Physical (vaults, security required) | Digital (secured by cryptography) |

| Scarcity | Limited (finite earth deposits) | Fixed (21 million cap, programmatically enforced) |

| Market Cap | ~$32 trillion9 | ~$1.9 trillion at ATH10 |

Extrinsic Value and Mimetic Desire

While gold has performed well historically during economic distress, this appreciation stems from extrinsic rather than intrinsic value. Gold is difficult to transport or store at scale. The precious metals industry is highly concentrated among a relatively small number of institutional players. Gold's price fluctuates primarily based on extrinsic valuation—collective belief in its value rather than fundamental utility.

Mimetic desire, as theorized by René Girard, suggests people desire objects because others desire them. In asset markets, this manifests as investors purchasing gold not for its industrial utility but because other investors and institutions value it, creating self-reinforcing price dynamics.

Figure 6: Gold Price Chart, Long-term. Gold's price action demonstrates a classic cup and handle technical pattern, a formation suggesting continuation of the prior uptrend based on historical price behavior rather than fundamental value changes.

Counterarguments to Bitcoin's Scarcity

In its current state, Bitcoin should not serve as a primary transactional currency due to price volatility. Arguments for a decentralized global currency have theoretical merit, but the practical reality favors continued USD dominance for near-term transactions.

Prominent Bitcoin advocates like Michael Saylor (MicroStrategy CEO) project significant USD devaluation and potential hyperinflation scenarios11. Simultaneously, Saylor's company and institutional investors are accumulating substantial Bitcoin positions, concentrating ownership among corporate and Wall Street entities rather than distributing it broadly. This introduces new dynamics around ownership concentration and institutional influence.

Instead of serving as a payment mechanism, Bitcoin could function as a store of value due to its advantages over gold listed in the table above. Scarcity is a key component of both gold and Bitcoin's value proposition.

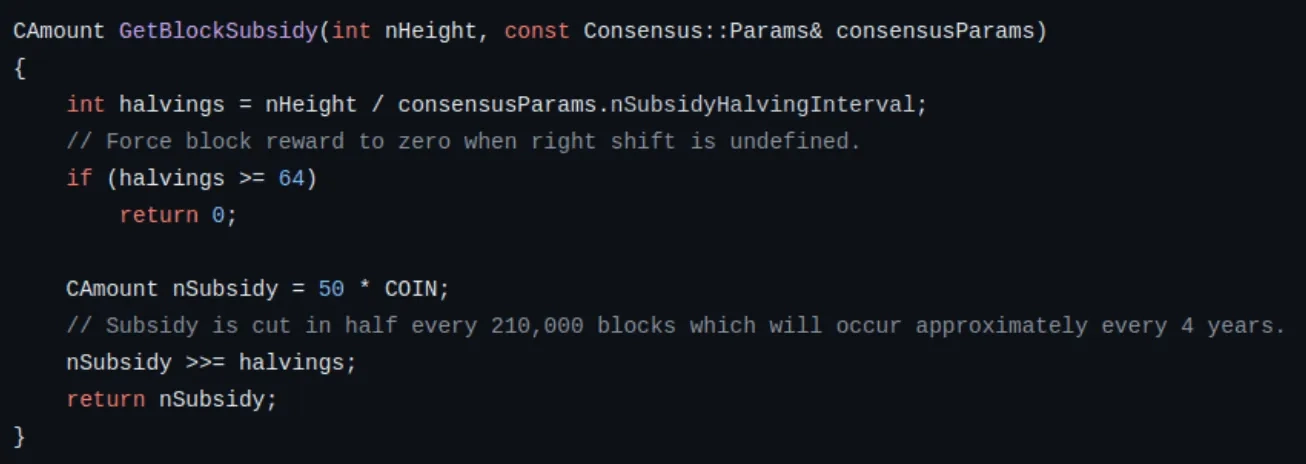

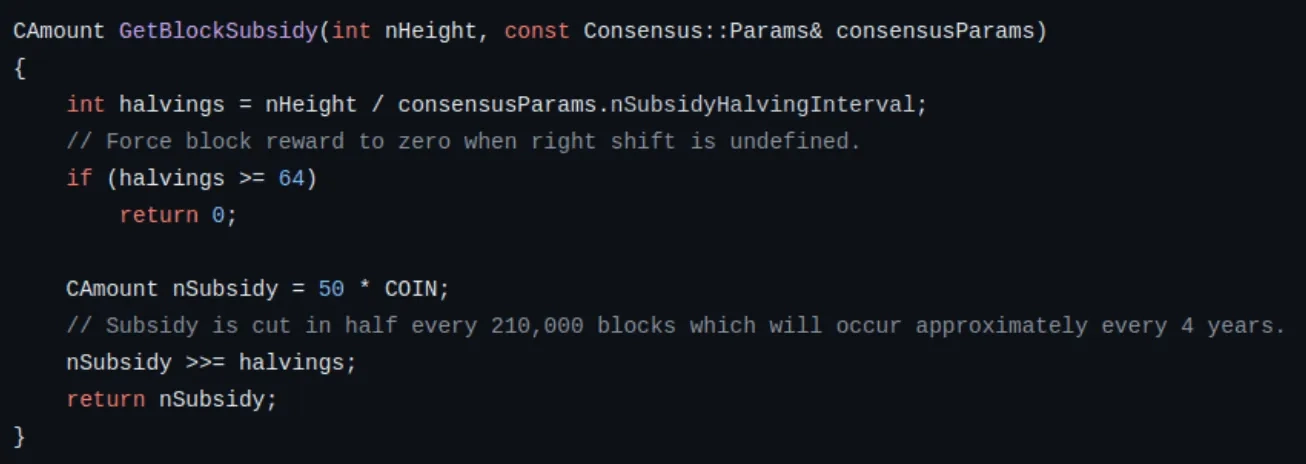

Gold's scarcity depends on geological factors (finite earth deposits), extraction economics (mining costs), physical properties (metal streaming), speculative future supply (asteroid mining)12, and institutional concentration. Bitcoin's scarcity depends on approximately 20 lines of code13:

Figure 7: Bitcoin Supply Cap Code. The Bitcoin protocol's supply cap is enforced through consensus rules in the software. This code limits total supply to 21 million BTC, with the final bitcoin scheduled for mining around 214014.

A small group of Bitcoin Core developers maintains the reference implementation software. Any protocol change requires consensus among this development community and, critically, adoption by the majority of network participants (miners, node operators, users). Currently, consensus rules define a maximum supply of 21 million BTC. Most of that supply already exists, with the final bitcoin scheduled for creation around 214014.

If all Bitcoin Core developers agreed to change the supply cap, a majority of computers on the network would still need to update their software and validate the new supply schedule. Bitcoin's verification process—proof-of-work mining—is an expensive undertaking. High capital and energy costs have resulted in a small number of mining pools controlling the majority of network hash power15.

While the 21 million cap theoretically could be changed, doing so contradicts the economic interests of developers, miners, and the network participants. Such a change would likely require a catastrophic event or fundamental shift in network incentives16.

However, Bitcoin faces several risks that potential investors should consider17:

Regulatory Risk: Government crackdowns, restrictions on exchanges, or outright bans could significantly impair accessibility and value.

Technological Vulnerabilities: While the Bitcoin protocol has proven robust, quantum computing advances or undiscovered cryptographic vulnerabilities pose theoretical long-term risks.

Extreme Price Volatility: Bitcoin has experienced multiple 80%+ drawdowns, making it unsuitable for risk-averse investors or short time horizons.

Physical Security Threats: The $5 wrench attack represents a fundamental security concern where physical coercion bypasses cryptographic protections. High-profile attacks on cryptocurrency holders highlight real-world security challenges facing the industry.

Conclusion

Although gold has not served as a practical transactional currency for centuries, major financial institutions and portfolio managers recommend allocating 1-5% of investment portfolios to gold as a safe-haven asset18. Gold will store value until collective belief shifts and it doesn't.

If scarcity is the dominant argument for value, more scarce assets could replace gold if market narratives shifted. Bitcoin is one such candidate. Its fixed supply, superior portability, instant verifiability, and global transferability offer technological advantages over physical gold.

However, Bitcoin's volatility, regulatory uncertainty, and relative youth as an asset class distinguish it from millennia-old gold. Gold has 5,000+ years of cultural and institutional acceptance as a store of value. Bitcoin has 16 years.

Whether Bitcoin earns the title depends on sustained collective belief. Gold has 5,000 years of it. Bitcoin has 16.

Using the BLS CPI Inflation Calculator, $1 in 1913 has the purchasing power of approximately $30-33 in 2024, representing ~97% purchasing power loss.

See FRED Economic Data - Bank Net Interest Margin.

The pizzas were valued at approximately $25-30 at the time.

See Bitcoin Pizza Day.

Central banks and international organizations hold approximately 35,000 tonnes.

See World Gold Council - Gold Reserves.

See DOJ Press Release.

See his interviews and MicroStrategy Bitcoin strategy announcements.

See Bitcoin Core GitHub Repository.

The final satoshi will be mined approximately in the year 2140.

Top 5 mining pools often control 60-70% of hash power.

Economic incentives strongly disfavor such a change.

See Ammous, Saifedean. The Bitcoin Standard (2018).

Conservative advisors typically recommend 1-5%.

See Investopedia - Gold Portfolio Allocation.

Footnotes

-

Bureau of Labor Statistics CPI data, 1913-2024. ↩

-

Historical US Treasury yields available from US Department of the Treasury. ↩

-

Federal Reserve data on bank Net Interest Margin (NIM). ↩

-

For detailed analysis of money's functions, see Federal Reserve Education - Functions of Money. ↩

-

The famous "Bitcoin Pizza Day" transaction occurred on May 22, 2010, when Laszlo Hanyecz paid 10,000 BTC for two Papa John's pizzas. ↩

-

Bitcoin price data from major exchanges (Coinbase, Binance, Kraken). The all-time high of ~$126,000 was reached in October 2025, following spot ETF approval in January 2024 and subsequent institutional inflows. Bitcoin's market cap reached approximately $1.9 trillion at peak. ↩

-

World Gold Council data on official gold reserves. ↩

-

JPMorgan Chase paid nearly $1 billion in fines for precious metals market manipulation (2020). ↩

-

Gold price approximately $4,672/oz as of January 2026, with an estimated 212,000 tonnes above ground. Total market cap calculation: 212,000 tonnes × 32,150 oz/tonne × $4,672/oz ≈ $32 trillion. This compares to U.S. stock market cap of ~$50 trillion. ↩

-

At the October 2025 ATH of ~$126,000, with ~19.5 million BTC in circulation, market cap reached approximately $1.9 trillion—roughly 6% of gold's market cap. The "digital gold" thesis implies potential for convergence if Bitcoin captures a portion of gold's store-of-value use case. ↩

-

Michael Saylor has made numerous public statements projecting USD inflation and promoting Bitcoin as an inflation hedge. ↩

-

While asteroid mining remains speculative, some asteroids contain substantial precious metal deposits. ↩

-

The Bitcoin supply cap is implemented in the Bitcoin Core codebase through the block subsidy halving mechanism. ↩

-

Bitcoin's mining reward halves approximately every 4 years (every 210,000 blocks). ↩ ↩2

-

Mining pool concentration data from Blockchain.com Pool Distribution. ↩

-

Changing Bitcoin's 21 million supply cap would require a contentious hard fork and would likely split the network. ↩

-

For comprehensive analysis of Bitcoin risks, see various sources including central bank research papers, academic studies, and industry analysis from firms like Fidelity Digital Assets. ↩

-

Traditional portfolio allocation frameworks (e.g., Ray Dalio's All Weather Portfolio) recommend 5-10% gold allocation. ↩

Digital Gold

finance

Why gold is valuable tells you why Bitcoin might be

8 min readJanuary 6, 2025

crypto

bitcoin

gold

inflation

Gold has 5,000 years of collective belief. Bitcoin has 16.

Whether Bitcoin becomes "digital gold" depends on the same thing gold depends on: sustained collective belief. The technology provides advantages—better portability, instant verifiability, programmable scarcity. But gold's value isn't about technology. It's about mimetic contagion: people value it because other people value it.

Key Takeaways

- Gold's value is mostly extrinsic. Beyond limited industrial use, it's valuable because we collectively believe it's valuable.

- Bitcoin offers technological advantages: portable (private keys), divisible (satoshis), verifiable (instant cryptographic proof), fixed supply (21 million cap).

- The US dollar has lost ~97% of its purchasing power since 1913. For people in Turkey or South Africa, the losses are worse and faster.

- Bitcoin's scarcity depends on ~20 lines of code and network consensus. Gold's depends on geology. Neither is absolute.

Inflation

Inflation is the rate at which the general price level of goods and services rises. Financial regulators employ various methodologies to measure inflation, and monetary policy uses inflation as a mechanism to manage debt obligations over time. This allows governments to repay debt with currency of diminished value compared to when borrowed, effectively transferring wealth from creditors to debtors. Over time, this leads to loss of purchasing power and increased nominal asset prices, primarily benefiting asset owners while impacting wage earners at the point of consumption.

Traditional financial systems have experienced persistent inflation for centuries. The US Dollar, the world's dominant reserve currency, has lost approximately 97% of its purchasing power since the Federal Reserve's establishment in 19131. To help individuals hedge against inflation, governments offer bonds that pay fixed rates of return. These returns have typically ranged between 2-4% annually over recent decades2.

Banks capitalize on the spread between rates paid to depositors on savings accounts and rates received from government bonds and lending activities3. At certain periods, while government bond yields exceeded 2%, major banks offered savings rates as low as 0.01%—a spread of nearly 200:1.

Stores of Value

Money serves three purposes: unit of account, store of value, and medium of exchange4. If currency cannot be used to purchase goods and services, it fails as money. If it loses significant value over a year, a day, or even an afternoon—as the German population experienced during the 1923 hyperinflation documented in When Money Died—it fails as money.

Rather than hold depreciating national currencies like the Turkish Lira or South African Rand and experience declining purchasing power, many individuals have adopted Bitcoin, USDT, or other cryptocurrencies that enable pseudonymous, secure value transfers and opportunities for capital appreciation. USD remains the dominant global reserve currency. All other currencies are priced against and dependent upon it. For national currencies, appreciation against USD generally indicates economic weakness, as it requires more local currency to purchase the same quantity of USD.

The Turkish Lira has lost most of its value since 2018:

Figure 1: Turkish Lira Devaluation vs USD, 2018-2025. The TRY/USD exchange rate demonstrates severe currency devaluation, with the lira losing over 80% of its value against the dollar during this period due to inflation and monetary policy challenges.

The South African Rand has experienced extreme volatility over the past decade:

Figure 2: South African Rand vs USD, 2014-2025. The ZAR/USD exchange rate exhibits sustained volatility and general depreciation trend, reflecting South Africa's economic challenges and commodity price dependencies.

Bitcoin holders have substantially outperformed holders of traditional currencies over the past decade. The famous "Bitcoin Pizza" transaction saw 10,000 BTC exchanged for two pizzas valued at approximately $25-30 on May 22, 2010, representing a price of roughly $0.0025-0.003 per BTC5. Bitcoin reached an all-time high of $126,000 in October 2025, trading around $93,000 as of January 2026.6

Figure 3: Bitcoin price, 2010-2025.

USD holders experienced significant purchasing power decline relative to Bitcoin over this period:

Figure 4: USD purchasing power vs Bitcoin, 2010-2025.

Gold

Physical gold bars have historically outperformed most assets during periods of economic uncertainty. As a result, gold has become a safe haven asset in the portfolio allocation frameworks of institutional investors.

Capital flows from speculative investments to safe-haven assets do not occur automatically. They result from investor psychology influenced by mimetic desire—people valuing assets because others value them—often manifesting gradually before accelerating rapidly in a phenomenon known as mimetic contagion.

Beyond its use in jewelry and select manufacturing applications (electronics, aerospace), gold is perceived to exist outside traditional financial systems. However, central banks and financial institutions hold the largest gold reserves globally7. Gold derivatives markets are substantial, and price manipulation cases have resulted in significant regulatory enforcement actions8.

Figure 5: JPMorgan Gold Market Manipulation. JPMorgan Chase faced nearly $1 billion in fines for precious metals market manipulation, highlighting how even "safe haven" assets are subject to institutional price manipulation through derivative markets.

Digital Gold

Investors and media analysts have referred to Bitcoin as "digital gold," partly because this analogy provides the most accessible framework for understanding its market role and partly because the comparison has validity.

| Feature | Physical Gold | Bitcoin |

|---|---|---|

| Portability | Limited (heavy, physical) | Excellent (private keys enable global transfer) |

| Divisibility | Limited (physical constraints) | Highly divisible (to 8 decimal places: satoshis) |

| Verifiability | Requires testing (assay, purity tests) | Instant, certain (cryptographic verification) |

| Transfer | Slow, expensive (shipping, insurance) | Near-instant, global (blockchain settlement) |

| Storage | Physical (vaults, security required) | Digital (secured by cryptography) |

| Scarcity | Limited (finite earth deposits) | Fixed (21 million cap, programmatically enforced) |

| Market Cap | ~$32 trillion9 | ~$1.9 trillion at ATH10 |

Extrinsic Value and Mimetic Desire

While gold has performed well historically during economic distress, this appreciation stems from extrinsic rather than intrinsic value. Gold is difficult to transport or store at scale. The precious metals industry is highly concentrated among a relatively small number of institutional players. Gold's price fluctuates primarily based on extrinsic valuation—collective belief in its value rather than fundamental utility.

Mimetic desire, as theorized by René Girard, suggests people desire objects because others desire them. In asset markets, this manifests as investors purchasing gold not for its industrial utility but because other investors and institutions value it, creating self-reinforcing price dynamics.

Figure 6: Gold Price Chart, Long-term. Gold's price action demonstrates a classic cup and handle technical pattern, a formation suggesting continuation of the prior uptrend based on historical price behavior rather than fundamental value changes.

Counterarguments to Bitcoin's Scarcity

In its current state, Bitcoin should not serve as a primary transactional currency due to price volatility. Arguments for a decentralized global currency have theoretical merit, but the practical reality favors continued USD dominance for near-term transactions.

Prominent Bitcoin advocates like Michael Saylor (MicroStrategy CEO) project significant USD devaluation and potential hyperinflation scenarios11. Simultaneously, Saylor's company and institutional investors are accumulating substantial Bitcoin positions, concentrating ownership among corporate and Wall Street entities rather than distributing it broadly. This introduces new dynamics around ownership concentration and institutional influence.

Instead of serving as a payment mechanism, Bitcoin could function as a store of value due to its advantages over gold listed in the table above. Scarcity is a key component of both gold and Bitcoin's value proposition.

Gold's scarcity depends on geological factors (finite earth deposits), extraction economics (mining costs), physical properties (metal streaming), speculative future supply (asteroid mining)12, and institutional concentration. Bitcoin's scarcity depends on approximately 20 lines of code13:

Figure 7: Bitcoin Supply Cap Code. The Bitcoin protocol's supply cap is enforced through consensus rules in the software. This code limits total supply to 21 million BTC, with the final bitcoin scheduled for mining around 214014.

A small group of Bitcoin Core developers maintains the reference implementation software. Any protocol change requires consensus among this development community and, critically, adoption by the majority of network participants (miners, node operators, users). Currently, consensus rules define a maximum supply of 21 million BTC. Most of that supply already exists, with the final bitcoin scheduled for creation around 214014.

If all Bitcoin Core developers agreed to change the supply cap, a majority of computers on the network would still need to update their software and validate the new supply schedule. Bitcoin's verification process—proof-of-work mining—is an expensive undertaking. High capital and energy costs have resulted in a small number of mining pools controlling the majority of network hash power15.

While the 21 million cap theoretically could be changed, doing so contradicts the economic interests of developers, miners, and the network participants. Such a change would likely require a catastrophic event or fundamental shift in network incentives16.

However, Bitcoin faces several risks that potential investors should consider17:

Regulatory Risk: Government crackdowns, restrictions on exchanges, or outright bans could significantly impair accessibility and value.

Technological Vulnerabilities: While the Bitcoin protocol has proven robust, quantum computing advances or undiscovered cryptographic vulnerabilities pose theoretical long-term risks.

Extreme Price Volatility: Bitcoin has experienced multiple 80%+ drawdowns, making it unsuitable for risk-averse investors or short time horizons.

Physical Security Threats: The $5 wrench attack represents a fundamental security concern where physical coercion bypasses cryptographic protections. High-profile attacks on cryptocurrency holders highlight real-world security challenges facing the industry.

Conclusion

Although gold has not served as a practical transactional currency for centuries, major financial institutions and portfolio managers recommend allocating 1-5% of investment portfolios to gold as a safe-haven asset18. Gold will store value until collective belief shifts and it doesn't.

If scarcity is the dominant argument for value, more scarce assets could replace gold if market narratives shifted. Bitcoin is one such candidate. Its fixed supply, superior portability, instant verifiability, and global transferability offer technological advantages over physical gold.

However, Bitcoin's volatility, regulatory uncertainty, and relative youth as an asset class distinguish it from millennia-old gold. Gold has 5,000+ years of cultural and institutional acceptance as a store of value. Bitcoin has 16 years.

Whether Bitcoin earns the title depends on sustained collective belief. Gold has 5,000 years of it. Bitcoin has 16.

Using the BLS CPI Inflation Calculator, $1 in 1913 has the purchasing power of approximately $30-33 in 2024, representing ~97% purchasing power loss.

See FRED Economic Data - Bank Net Interest Margin.

The pizzas were valued at approximately $25-30 at the time.

See Bitcoin Pizza Day.

Central banks and international organizations hold approximately 35,000 tonnes.

See World Gold Council - Gold Reserves.

See DOJ Press Release.

See his interviews and MicroStrategy Bitcoin strategy announcements.

See Bitcoin Core GitHub Repository.

The final satoshi will be mined approximately in the year 2140.

Top 5 mining pools often control 60-70% of hash power.

Economic incentives strongly disfavor such a change.

See Ammous, Saifedean. The Bitcoin Standard (2018).

Conservative advisors typically recommend 1-5%.

See Investopedia - Gold Portfolio Allocation.

Footnotes

-

Bureau of Labor Statistics CPI data, 1913-2024. ↩

-

Historical US Treasury yields available from US Department of the Treasury. ↩

-

Federal Reserve data on bank Net Interest Margin (NIM). ↩

-

For detailed analysis of money's functions, see Federal Reserve Education - Functions of Money. ↩

-

The famous "Bitcoin Pizza Day" transaction occurred on May 22, 2010, when Laszlo Hanyecz paid 10,000 BTC for two Papa John's pizzas. ↩

-

Bitcoin price data from major exchanges (Coinbase, Binance, Kraken). The all-time high of ~$126,000 was reached in October 2025, following spot ETF approval in January 2024 and subsequent institutional inflows. Bitcoin's market cap reached approximately $1.9 trillion at peak. ↩

-

World Gold Council data on official gold reserves. ↩

-

JPMorgan Chase paid nearly $1 billion in fines for precious metals market manipulation (2020). ↩

-

Gold price approximately $4,672/oz as of January 2026, with an estimated 212,000 tonnes above ground. Total market cap calculation: 212,000 tonnes × 32,150 oz/tonne × $4,672/oz ≈ $32 trillion. This compares to U.S. stock market cap of ~$50 trillion. ↩

-

At the October 2025 ATH of ~$126,000, with ~19.5 million BTC in circulation, market cap reached approximately $1.9 trillion—roughly 6% of gold's market cap. The "digital gold" thesis implies potential for convergence if Bitcoin captures a portion of gold's store-of-value use case. ↩

-

Michael Saylor has made numerous public statements projecting USD inflation and promoting Bitcoin as an inflation hedge. ↩

-

While asteroid mining remains speculative, some asteroids contain substantial precious metal deposits. ↩

-

The Bitcoin supply cap is implemented in the Bitcoin Core codebase through the block subsidy halving mechanism. ↩

-

Bitcoin's mining reward halves approximately every 4 years (every 210,000 blocks). ↩ ↩2

-

Mining pool concentration data from Blockchain.com Pool Distribution. ↩

-

Changing Bitcoin's 21 million supply cap would require a contentious hard fork and would likely split the network. ↩

-

For comprehensive analysis of Bitcoin risks, see various sources including central bank research papers, academic studies, and industry analysis from firms like Fidelity Digital Assets. ↩

-

Traditional portfolio allocation frameworks (e.g., Ray Dalio's All Weather Portfolio) recommend 5-10% gold allocation. ↩